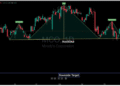

I am a stock expert with over twenty years of experience in quantitative research study, monetary modeling, and danger management. My focus is on equity appraisal, market patterns, and portfolio optimization to reveal high-growth financial investment chances. As a previous Vice President at Barclays, I led groups in design recognition, tension screening, and regulative financing, establishing a deep knowledge in both basic and technical analysis. Together with my research study partner (likewise my partner), I co-author financial investment research study, integrating our complementary strengths to provide top quality, data-driven insights. Our method mixes extensive danger management with a long-lasting viewpoint on worth production. We have a specific interest in macroeconomic patterns, business profits, and monetary declaration analysis, intending to offer actionable concepts for financiers looking for to outshine the marketplace.

Expert’s Disclosure: I/we have no stock, choice or comparable acquired position in any of the business pointed out, and no strategies to start any such positions within the next 72 hours. I composed this short article myself, and it reveals my own viewpoints. I am not getting payment for it (besides from Looking For Alpha). I have no company relationship with any business whose stock is pointed out in this short article.

Looking for Alpha’s Disclosure: Previous efficiency is no assurance of future outcomes. No suggestion or suggestions is being offered regarding whether any financial investment appropriates for a specific financier. Any views or viewpoints revealed above might not show those of Looking for Alpha as a whole. Looking for Alpha is not a certified securities dealership, broker or United States financial investment advisor or financial investment bank. Our experts are 3rd party authors that consist of both expert financiers and private financiers who might not be certified or accredited by any institute or regulative body.

Source: Seeking Alpha.