Gold (XAU/USD) has a hard time to profit from a modest intraday uptick to a one-and-a-half-week top, though it stays with a slightly favorable tone heading into the European session on Tuesday. Traders increase their bets for another rate of interest cut by the United States Federal Reserve (Fed) in December following the current remarks from prominent FOMC members, which continues to serve as a tailwind for the non-yielding yellow metal. Apart from this, consistent geopolitical unpredictabilities originating from the heightening Russia-Ukraine war and fresh disputes in the Middle East end up being another aspect benefiting the safe-haven product.

On The Other Hand, the United States Dollar (USD) sits near its greatest level because late Might, touched recently regardless of dovish Fed expectations, and functions as a headwind for the Gold rate. Furthermore, an usually favorable tone around the equity markets adds to topping the advantage for the rare-earth element. Traders likewise appear unwilling and decide to wait on crucial United States macro information– the postponed release of Manufacturer Rate Index (PPI) and Retail Sales– before placing for the next leg of a directional relocation for the XAU/USD set.

Daily Digest Market Movers: Gold bulls have the upper hand as Fed rate cut bets balanced out firmer USD and favorable threat tone

- New York City Federal Reserve President John Williams stated on Friday that rates of interest might fall in the near term without putting the reserve bank’s inflation objective at threat. Contributing to this, Fed Guv Christopher Waller stated on Monday that the task market is weak enough to call for another quarter-point rate cut in December.

- According to CME Group’s FedWatch tool, the futures-market-implied possibility of a 25 basis points rate decrease to a variety of 3.50% to 3.75% in December now stands at around 80%. This stops working to help the United States Dollar to develop on recently’s strong go up to a multi-month high and provides assistance to the non-yielding Gold.

- Russia released a wave of attacks on Ukraine’s capital, Kyiv, early Tuesday (November 25, 2025), striking property structures and energy facilities. The attack follows settlements in between the United States and Ukraine agents in Switzerland over the weekend about a US-brokered strategy to end an almost four-year-old war.

- The White Home stated United States President Donald Trump stays enthusiastic and positive that an offer can be struck, though he warned that any development stays unsure. According to a Ukrainian authorities, the US-proposed Russia-Ukraine peace strategy now has 19 points and does not consist of a rigorous limitation on the size of the Ukrainian army.

- The modifications, nevertheless, might extremely well be less appropriate to Russia. Moreover, Israel, according to the Gaza Federal Government Media Workplace, has actually breached the United States-brokered Gaza ceasefire a minimum of 497 times in 44 days. This keeps geopolitical dangers in play and ends up being another aspect supporting the safe-haven rare-earth element.

- Traders now eagerly anticipate Tuesday’s United States financial docket– including the postponed release of the United States Manufacturer Rate Index and Retail Sales figures, together with Pending Home Sales and Richmond Production Index. This might affect the USD rate characteristics and produce short-term trading chances around the XAU/USD set.

Gold appears poised to value additional and objective towards recovering the $4,200 mark

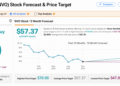

The over night strong go up confirmed a confluence assistance– making up an upward sloping trend-line extending from late October and the 200-period Exponential Moving Typical (EMA) on the 4-hour chart. The subsequent go up and favorable oscillators on 4-hour/daily charts back the case for an additional near-term valuing relocation for the XAU/USD set. Thus, some follow-through strength towards the $4,177-4,178 area, en path to the $4,200 round figure, appears like an unique possibility. The momentum might extend additional towards checking the month-to-month swing high, around the $4,245 zone.

On the other hand, any pullback listed below the $4,132-4,130 location may now be viewed as a purchasing chance and discover good assistance near the $4,110-4,100 area. A persuading break listed below the latter would expose the previously mentioned confluence, presently pegged near the $4,032-4,030 zone, which, if broken, may move the near-term predisposition in favor of bears and drag the Gold rate to the $4,000 mental mark. Some follow-through selling ought to lead the way for a fall towards recently’s swing low, around the $3,968-3,967 location, en path to the $3,931 assistance, the $3,900 mark and late October swing low, around the $3,886 area.

United States Dollar Rate Last 7 Days

The table listed below programs the portion modification of United States Dollar (USD) versus noted significant currencies last 7 days. United States Dollar was the greatest versus the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.58% | 0.39% | 0.97% | 0.50% | 0.56% | 1.01% | 1.58% | |

| EUR | -0.58% | -0.20% | 0.38% | -0.09% | -0.03% | 0.40% | 0.98% | |

| GBP | -0.39% | 0.20% | 0.62% | 0.11% | 0.18% | 0.61% | 1.19% | |

| JPY | -0.97% | -0.38% | -0.62% | -0.48% | -0.42% | 0.00% | 0.59% | |

| CAD | -0.50% | 0.09% | -0.11% | 0.48% | 0.07% | 0.49% | 1.08% | |

| AUD | -0.56% | 0.03% | -0.18% | 0.42% | -0.07% | 0.43% | 1.01% | |

| NZD | -1.01% | -0.40% | -0.61% | -0.00% | -0.49% | -0.43% | 0.57% | |

| CHF | -1.58% | -0.98% | -1.19% | -0.59% | -1.08% | -1.01% | -0.57% |

The heat map reveals portion modifications of significant currencies versus each other. The base currency is chosen from the left column, while the quote currency is chosen from the leading row. For instance, if you choose the United States Dollar from the left column and move along the horizontal line to the Japanese Yen, the portion modification showed in package will represent USD (base)/ JPY (quote).

Source: FXstreet.