Bitcoin’s (BTC) cost has actually had a hard time to restore momentum following Wednesday’s drop to $100,700, leaving BTC down approximately 3.5% on the weekly candle light. Market information reveals long-lasting holders have actually offered more than 815,000 BTC over the previous 1 month, magnifying the concentrate on lower liquidity pockets. Experts now indicate the June 2025 lows near $98,000 as the next most likely target if volatility speeds up.

Secret takeaways:

-

Liquidity clusters reveal disadvantage pressure structure near $98,000 for Bitcoin.

-

A 4th retest of $102,000 to $100,000 assistance signals a weakening structure.

-

Futures trader positioning stays long-heavy in spite of increasing technical dangers.

BTC liquidity compression heightens disadvantage focus

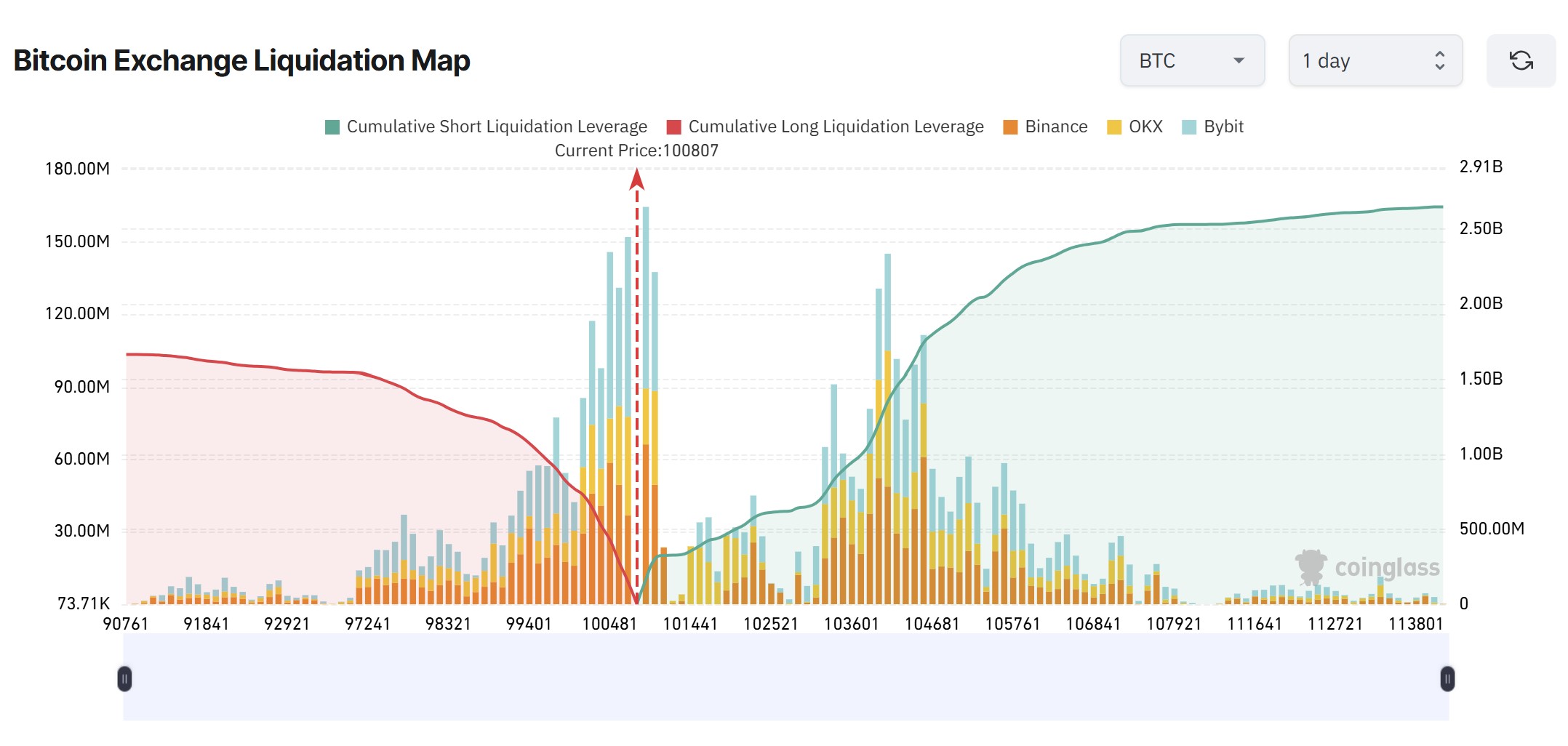

Experts tracking BTC’s liquidity map highlight an expanding imbalance in between assistance and overhead resistance. Crypto trader Daan kept in mind that a “big cluster of liquidity sits listed below the regional lows at $98,000–$ 100,000,” including that this lines up with the series of partially greater lows that have actually formed above the zone.

The trader likewise indicated significant benefit levels at $108,000 and $112,000 however worried that just the previous is presently actionable provided the marketplace structure, with whichever band breaks initially most likely setting off a sharp capture.

Futures trader Byzantine General echoed the belief, observing that existing cost habits recommends Bitcoin “is most likely to sweep the lows around $98,000”.

Supporting this view, CoinGlass information reveals almost $1.3 billion in cumulative long leveraged liquidity focused at the $98,000 level, a high increase from earlier in the week, while futures traders had actually formerly gone for upside liquidity near $110,000, following the current flush listed below $100,000 last Friday.

Related: Crypto most ‘afraid’ given that March as Bitcoin eyes 1 year lows versus gold

Repetitive assistance retests deepen structural threat

Bitcoin has actually now evaluated the $102,000–$ 100,000 assistance band for the 4th time given that the variety was very first developed in Might 2025. Several retests of the exact same assistance typically show structural fatigue: each subsequent see deteriorates purchaser conviction, minimizes resting quote liquidity, and increases the possibility of a breakdown.

Expert UBCrypto kept in mind that the most recent relocation looked like a stopped working breakout, including that it is “not a level worth purchasing into” up until cost validates strength, even if that indicates returning to a couple of portion points greater.

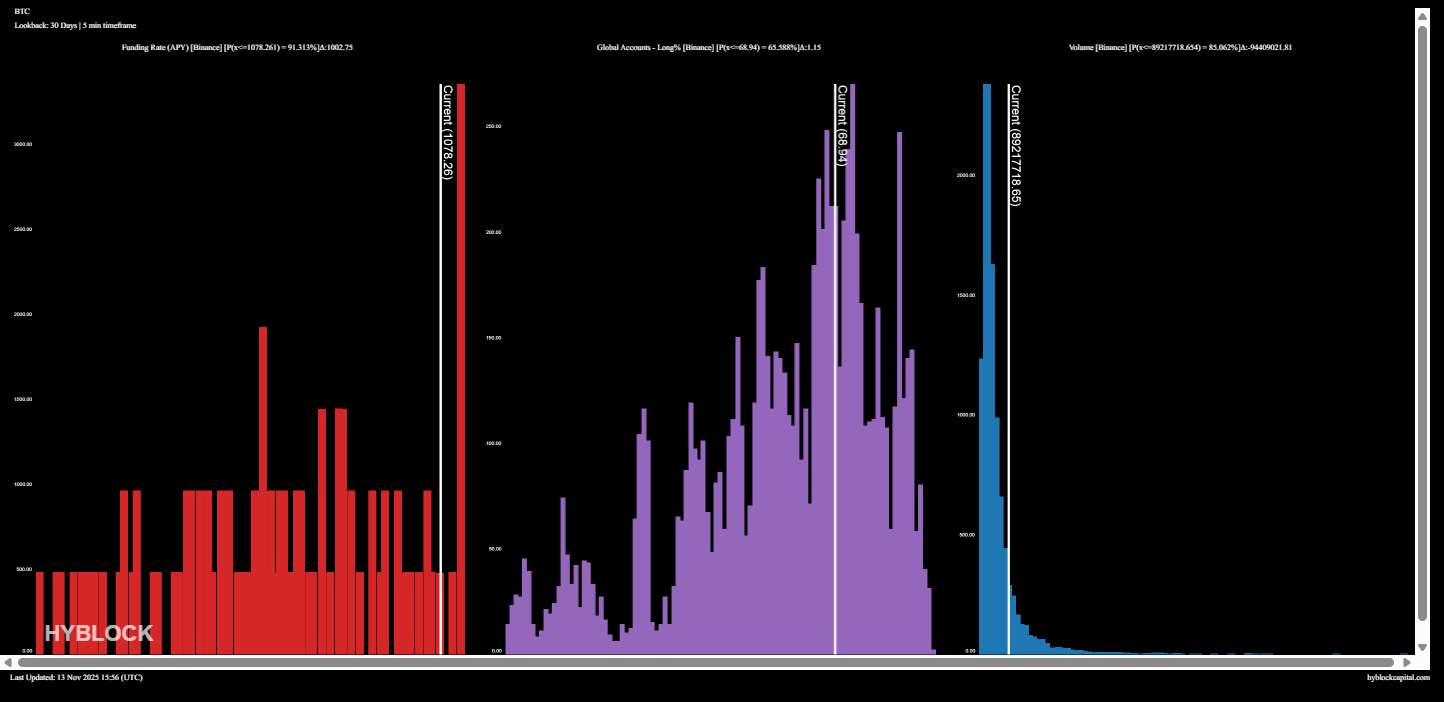

Regardless of this, information from Hyblock Capital reveals that long positioning stays dominant, with 68.9% of worldwide BTC orders leaning long on Binance, showing that numerous traders continue to rely on the $100,000 flooring.

Nevertheless, both the day-to-day and weekly charts show a softness at greater timespan, increasing the possibility of a liquidity sweep towards $98,000, even as much deeper order book assistance seems stacked above the existing cost.

Related: Bitcoin’s second-largest whale build-up stops working to press BTC past $106K

This post does not consist of financial investment suggestions or suggestions. Every financial investment and trading relocation includes threat, and readers ought to perform their own research study when deciding.

Source: Coin Telegraph.